Cnhi Network

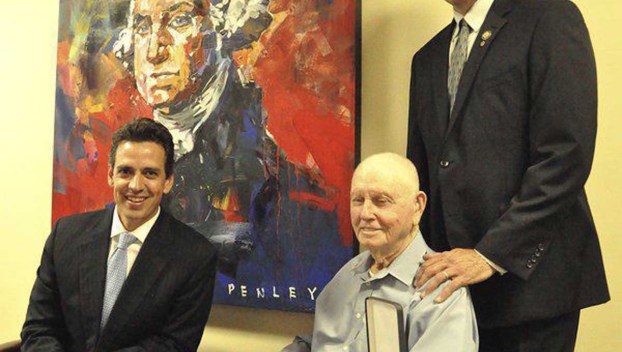

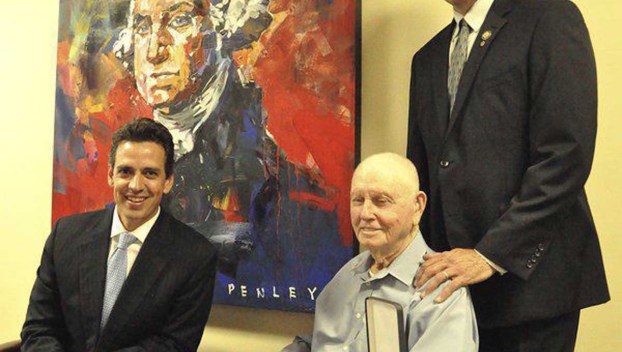

WWII veteran receives medals after 71 years

DALTON, Ga. –– After waiting for 71 years, World War II veteran Clarence Richardson was finally presented with ... Read more

DALTON, Ga. –– After waiting for 71 years, World War II veteran Clarence Richardson was finally presented with ... Read more

ATLANTA — Georgia residents who lease vehicles will pay less in taxes under a proposal that could deal a ... Read more

ATLANTA — A move to let more Georgians use medical cannabis is nearing a final vote in the ... Read more