Renters face steep rise in housing costs

Published 12:00 am Tuesday, May 23, 2023

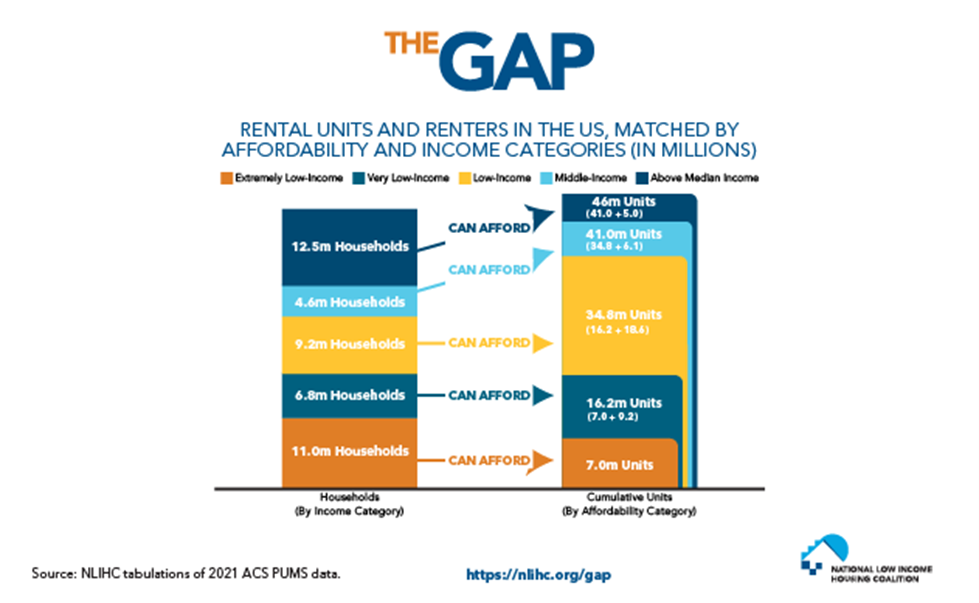

- This chart shows the breakdown of what amount of renters can afford housing. Courtesy | National Low Income Housing Coalition

Editor’s Note: These are parts 5 and 6 of a 10-part series highlighting the challenges of affordable housing in Alabama and nationwide. Parts 7 and 8 will publish June 8.

Sian Anderson’s small apartment on the far east side of Indianapolis had a cracked ceiling, faulty electrical outlets and a sloping floor.

Those issues didn’t stop the landlords from steadily increasing her rent from $540 to over $600 — she was gone before she found out the final amount — during her three years in the unit.

For Anderson, who lives on disability benefits, the extra rent money was tough to find. The 50-year-old started hitting food pantries to save enough cash to pay.

It wasn’t enough. Anderson missed her rent one month. Then the next. The property owners began fining her for the late payments. Then they evicted her in April.

Anderson found herself sleeping in her car inside a storage unit. She was forced to leave after someone called the police. Now, she’s staying with a friend until she can figure out what to do next.

“I’m in limbo,” Anderson said. “I’m just so frustrated. I don’t know which way is up right now.”

During the past month, reporters from CNHI News nationwide have sought to examine the issues surrounding affordable housing, who is most impacted by a lack of it and what solutions states and communities have implemented in this multipart special report.

Skyrocketing rental prices

Anderson is far from alone. Over the past three years, skyrocketing rent prices have contributed to an alarming spike in eviction rates for low- to moderate-income earners around the nation.

Take Oklahoma City, where the asking rate in September shot up 24% compared to a year before, according to an analysis by Redfin, a real estate brokerage network.

That’s the nation’s largest price jump in a major metropolitan area, and it came with a historic number of evictions. Oklahoma County, in which the city is mostly located, saw nearly 1,800 more eviction filings from January through July compared to the same period in 2019.

Evictions usually drop sharply in March and April, when tenants receive federal tax refunds they can use to stay current on their rent, according to Ryan Gentzler, the former research director at the Oklahoma Policy Institute.

But not last year. The county set an all-time high of over 1,600 eviction filings in March 2022.

“The eviction tsunami has arrived in Oklahoma County and may not be far behind elsewhere across the state,” Gentzler said.

During the past month, reporters from CNHI News nationwide have sought to examine affordable housing issues, who is most impacted by a lack of it, and what solutions states and communities have implemented in this multipart special report.

Renters across the country are in the same predicament. Other cities like Pittsburgh, Indianapolis, Louisville, Cincinnati, New York City and Raleigh, North Carolina, all saw year-over-year rental increases of more than 15%, the Redfin study found. Nationally, the median asking rent rose 9% in September to $2,000.

That led 3.6 million Americans to report in April that they are not current on their rent or mortgage, and chances are likely they will experience an eviction or foreclosure, according to data from the U.S. Census Bureau’s Household Pulse Survey. That’s over 31% of people who responded to the survey.

The reasons behind soaring rent prices aren’t complicated, according to Leah Cuffy, director of advocacy research at the National Apartment Association. It comes down to basic supply and demand.

During the pandemic, more people preferred renting instead of buying, especially baby boomers. Many who wanted to buy couldn’t due to the short supply of available homes and ballooning home prices, further driving up demand for rentals, Cuffy said.

That led to historically low vacancy rates last year for rentals (5.6%) and homes (0.8%) as Americans filled up most of the nation’s remaining housing inventory, according to data from the U.S. Census Bureau.

Landlords responded by raising rents, in part to make more money, but also to keep up with increasing operational costs due to high inflation, Cuffy said.

But for low- to moderate-income tenants living paycheck to paycheck, finding ways to cut spending to afford higher rent can be painful — or simply impossible, according to Andrew Bradley, the policy director at Prosperity Indiana, the state’s community economic development association.

Those residents end up moving into smaller, cheaper and shabbier units often located in unsafe neighborhoods. Or they get evicted and wind up living with family and friends. In the worst-case scenario, those people become homeless, Bradley said.

“Those folks that are in the tightest pinch really have the fewest options,” he said. “You add a rent increase on top of that, and you’re putting an already vulnerable population into some really dire straits.”

Peter Hepburn, associate director of The Eviction Lab, a research group based at Princeton University, said that’s happening almost everywhere. Every city and state tracked by The Eviction Lab saw an increase in filings between 2021 and 2022. Half of those places are above historical averages and higher than before the COVID-19 pandemic.

Since January, rental prices nationally have started to cool, with annual rate increases slowly dropping back to pre-pandemic levels. But the record high asking prices? Those aren’t coming down anytime soon, Hepburn said.

Until that happens, low-income residents like Anderson, who was evicted last month from her Indianapolis apartment, have few options and little hope of finding an affordable place to stay.

“I did not like where I lived, but it was home,” she said. “And if things don’t go well, then I will be sleeping in a parking lot or living in my car.”

1. Oklahoma City, OK (24.1%)

2. Pittsburgh, PA (20%)

3. Indianapolis, IN (17.9%)

4. Louisville, KY (17.5%)

5. Nashville, TN (17%)

6. Cincinnati, OH (16.5%)

7. Raleigh, NC (16.4%)

8. New York, NY (15.4%)

9. Portland, OR (14%)

10. San Antonio, TX (12.5%)

Five of the 50 most populous metro areas saw rents fall in September from a year earlier. Rents declined 14.3% in Milwaukee, 8.8% in Minneapolis, 2.8% in Baltimore and less than 1% in Houston and Chicago.

Source: Redfin study